In fact they even went out and beat the general consensus by 3 cents. Demand for microprocessors have been very strong for the last 18 months that it's always a wonder why one company can take all the profit while the other member of the duopoly loses $Billions.

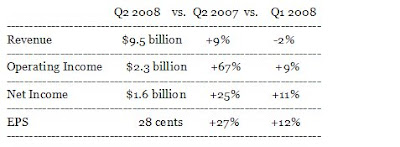

Intel Corporation today announced record second-quarter revenue of $9.5 billion, operating income of $2.3 billion, net income of $1.6 billion and earnings per share (EPS) of 28 cents. "Intel had another strong quarter with revenue at the high end of expectations and earnings up substantially year over year," said Paul Otellini, Intel president and CEO. "As we enter the second half, demand remains strong for our microprocessor and chipset products in all segments and all parts of the globe."  Results for the quarter included significantly lower NOR flash memory

Results for the quarter included significantly lower NOR flash memory

revenue along with restructuring and asset impairment charges of $96

million. Results for the first quarter of 2008 included the effects

of restructuring and asset impairment charges that lowered EPS by 4

cents. Results for last year's second quarter included tax items that

increased EPS by approximately 3 cents along with restructuring

charges of $82 million.

Guidance remains strong and unchanged from previous estimates for the remainder of the year.

-- Q3 Revenue: Between $10.0 billion and $10.6 billion.

-- Gross margin: 58 percent plus or minus a couple of points.

-- 2008 Gross margin: 57 percent plus or minus a couple of points, unchanged.

The desktop - laptop crossover for the consumer space happened in Q2 driving mobile ASPs down. Fortunately for Intel, they have another cross over happening in Q3 and that is the shift to 45nm. They expect unit cost to dramatically decline providing even more pricing advantage over AMD. The moment when Intel begins to recover investment spent on 45nm starts now until peak production volume. Only the company ahead on the process curve enjoys these returns. AMD on the other hand will spend billions on 45nm just so they can catch up. This is why Intel makes all the money.

Then again ,what we've seen since C2D was released is a general shift of financial analysts favouring Intel. These revenue, profit and margin benchmarks clearly favours Intel! All these making money thing doesn't represent real world.

7.15.2008

No bankruptcy for Intel in Q2’08 - Shocker!

Subscribe to:

Post Comments (Atom)

20 comments:

sorry for ot but does anyone else find it funny that sci is on a campaign to prove that anandtech is "clearly biased in favor of Intel" yet cant understand it when someone suggests that he favors AMD?

Captain double standards

You are wrong.

Scientia is not biased because he has pro-intel links on his site.

how dare anyone refute such argument?

I think his current claim is that it is much more widespread than Anand's site.

In some ways it's just stating the obvious. Intel has the majority of the market, which gives it the majority of the money. The majority of equipment out there to review is Intel based. The majority of people out there will therefore be more familiar with Intel. By definition, AMD is less popular, therefore, less favored...

"In some ways it's just stating the obvious."

No... he has alleged a willful and intentional 'conspiracy' (for lack of a better word). Benchmarking AMD video cards on Intel CPU's is not some grand conspiracy it is a reflection that it will appeal to the most users. Enthusiast sites not focusing on integrated graphics is not some conspiracy, it is a reflection of doing reviews that they think will reach their audience. Not focusing on cryptography? Perhaps again this is less attractive to folks reading the articles.

To say Scientia is simply stating the obvious is burying you head in the sand.

- Take a look over Scientia's blog and ask you how many of his blogs have an AMD 'slant' to them and how many have a 'slant' to Intel. - Take a look at how he has attempted to spin AMD's process technology (45nm is out now right?) and they continue to close the gap?

- Take a look at a recent comment: "Intel is just a bully that got lucky. People who follow them are sheep." If this were said about AMD, Scientia would have filtered it saying it was irrelevant and didn't add to the discussion.

- Take a look at how he tried to spin asset light/smart.

- Take a Look through the comments section - how many full comments are there that have favorable Intel views.... you simply get a comment which is cut into a Scientia comment (and who knows in what context as Scientia has chosen to filter it).

Attack the company... can't do that now as Intel is on top.... attack the roadmaps... can't do that so much anymore as AMD's roadmap has limited visibility and is not looking so strong... attack the reviewers... are they really all conspiring?... Finally attack the benchmarks... obviously folks are just being 'duped'

His blog is less a reflection of current state of fairs and unbiased analysis as he purports it to be, and more of a 'how can I accentuate AMD's strengths and downplay Intel's?'

Good summary, though I'm not sure I agree with this:

Only the company ahead on the process curve enjoys these returns. (referring to 45nm cost/margin benefits)

AMD will eventually see this - it will be just much later out (mid-late 2009), but they will see it (provided of course yields are reasonable).

I'm surprise the revenue guidance didn't have more of an impact after hours - the street estimate was 10.07Bil and that is at the bottom range of Intel's forecasted range. Given that the range is probably conservative as well, I would have thought this would have had a bigger impact on the stock price.

And I'm not sure why you think it is a wonder why one company makes money while the other doesn't. One company is run like a business, the other is run like an engineering company (best/most elegant design does not always mean best product from a business perspective). Once AMD decides to run their company like a business instead of like some personal 'break Intel's monopoly, even if it break us' philosophy they will start turning a profit.

First thing - Got to get rid of Ruiz and his ego driven decisions. I'm not sure Dirk will be better but I can't see him being worse.

Second thing - Take a page from ATI; you do not need to have the very best product or the most elegant design, you need something within striking range that is manufacturable (which allows you to compete on cost and in the mainstream). AMD CPU is turning out a 'cool' design with lots of theoretical advantages on paper that does not keep up and is less manufacturable. I though Puma might be this in the notebook world, but it's hard to tell. K10 certainly is the wrong direction outside of servers. The dark horse might be the no L3 cache K10's, if the performance hit is small, this should allow far better die per wafer (and perhaps yield), which should allow AMD to improve margins a bit.

It'll be interesting to see the AMD #'s and forecast on Thursday (especially after factoring out the one time charges/income nonsense)

hyc: "By definition, AMD is less popular, therefore, less favored..."

I think it has more to do with performance at the high end, which has become the focus for most sites. I recall that AMD was seen very favorably by many sites when they had the performance lead and Intel was scrambling to surpass them. Intel got ripped pretty hard by sites like HardOCP and Tom's Hardware when they introduced the 1.1GHz Pentium III.

At various times many of the hardware review sites lean one way or another. I can still recall Anand's puff piece about RDRAM, and my impression is that many sites ranted at Intel when it was struggling to keep up with AMD in performance.

There is no doubt that hardware companies can exert influence on review sites, but the current "slant" seems due more to the fact that Intel has been ahead at the high end of the curve since the release of Core2, and AMD has struggled with K10. The Radeon 48xx series of cards have been getting positive reviews on the net, and HardOCP just gave the 4870 X2 a rave review.

INTEL Q2 numbers are out, are there any questions who is executing well?

AMD numbers are coming, can't wait to see the excuse, promise of better things to come, roadmaps that never materialize, products that are late or disappear.

Got to ask, with INTEL executing so well on 45nm, ramping two more factories, Nehalem by all indicators looking good. What should AMD's plan be, how can they compete being a good year behind on manufacturing technology and much further on raw process performance and learning, how can they hope to compete?

And all the fanbois can do is blog it up on preceived bias review of benchmarks.

WTF cares, we want to discuss how the AMD fans think AMD is going to compete.

As we watch the clock tick down.

When did Sharikou said Intel would go bankrupt again?

He swings at nVidia one day then swings at Intel the next day.

Hard to do when the poor bastard has no arms, no legs, and no brains.

LMAO

Tonus-

“I think it has more to do with performance at the high end, which has become the focus for most sites.”

Yeah, to a point, but like everything else, there are exceptions. AMD was given a pass by the press from 3Q 2006 after C2D was released, up to 2Q 2007 even after Barcelona fell on it ass. I can recall it was, Barcelona this and Barcelona that, the press gobbled it up hook line and sinker.

It wasn’t until the end of 2Q 2007 when ‘Digitimes’ wrote a scathing article about AMD PP posturing did the tech sites, one by one, wake up and smell the coffee. Their credibility was in question. AMD pimp extraordinaire, Charlie D. had engineers “Dancing in the aisles”. (Actually, given the circumstances of the time, they were probably scrambling for their lives!)

Then, former paid shill Mike Magee, who thought he was an AMD insider, called AMD for a Barcelona status report. They, in his words, “almost bit my head off.” He was pissed, duped, and he said so.

Basically, it took the press a year, or better, to finally come to realize AMD’s day in the sunshine was over, and even longer to admit Barcelona was a dog. This was especially true for that idiot Fuddo who kept us all waiting for the next stepping.

The “Scrappy Little” underdog was given a subjective pass way after C2D was kicking some serious ass, when AMD had absolutely nothing. They still don’t. 45nM is still leaking juice like a stuck pig. Only one guy reported the bleeding preview of Pheromone at 45nM. “It sucks less”

http://www.overclockers.com/tips01361/

ALL the other sites have conspicuously ignored this preview.

And sorry, I couldn’t give this ‘hyc’ comment a pass, even though I tried.

“The majority of equipment out there to review is Intel based.”

First, it’s ALL INTEL BASED, they hold the X86 license!

Secondly, AMD’s performance per watt, performance per dollar, performance per dream land, whatever, is garbage. INTC has them beat on every front. There’s nothing AMD has that is worth the review without making looking terrible in contrast! Embarrassment by default, perhaps!?!? Better to say nothing. Graciously, they don’t.

I defy you to find one review, anywhere, where QX9770 is compared/reviewed directly with ANY Pheromone at stock speeds, then at max overclocked speeds. Basically, AMD’s best versus INTC best. You won’t.

This not a ‘popularity contest’, it’s the slow death of company who played the press like a fiddle, when INTC fell asleep, a la Henri Richard. He took the press for a ride in the Ferrari, in AMD’s heyday, and the press was eating out of his hands. Then he went away. So will AMD.

We will look at all the press nonsense, in retrospect, and realize how wrong and biased they really were/are. (As we are now) I for one will never forget the last two years of tech/website bullshit, directly in the face of 4 billion in losses.

Call it ‘The 40 to 4 Hype’.

This was, and is, the only website that has called it perfectly all along.

That’s why I’m here everyday.

SPARKS

Sparks said ....

INTC has them beat on every front.

As much as I appreciate the enthusiasm, this just isn't true. In the 4P+ space, AMD is still the best bang for your buck. It will stay that way until Intel brings out Nehalem with a 4-way QPI in 2H'09.

Oh wait, I'm not supposed to correct misinformation regarding AMD on this site, am I?

Please disregard the above comment, despite the fact it is true. INTEL uber alles!!! Intel rulz.

"As much as I appreciate the enthusiasm, this just isn't true. In the 4P+ space, AMD is still the best bang for your buck. It will stay that way until Intel brings out Nehalem with a 4-way QPI in 2H'09."

In enterprise, the concept of 'bang-for-the-buck' is not as critical as it is with the enthusiast crowd, a good portion of which are teenagers using lawn mowing money, or college students scaping pennies, to make a rig..... sure costs is a factor, but total cost of ownership, and performance are critical ... SW license runs more than HW, as well as maintenance, etc.... Unlike retail where the lower end chips sell best, in 2P and 4P the higher bins are the more choice chips. And top bin to top bin, Intel wins.

The 4P space mimics the 2P space in a certain regard ... for applications with massive BW requirements, then yes AMD is a better choice in this space (and, hence, you make a good point -- though I suspect Dunnington will change this), in other apps Intel still holds the lead.... AMD, quite logically, only shows or has submitted benchmark data that they win on (this is basic marketing 101, you cannot fault them for that).

Truth be told, it is not as domineering as people may think.

ITK-

“As much as I appreciate the enthusiasm, this just isn't true.”

Quite right, 4P space, from what I’ve read (I have no hands on, actual working knowledge) performs best. However, what I do know is where the money is. I’m typing on it so, does roughly 80 percent of the rest of the planet, they are too. 2P, 4P, Baloney, as you say this too, shall pass.

Really, I can’t wait till Nehalem puts this last pubic hair of an IMC, high margin low volume processor scaling thing to rest, once and for all. Besides, the guns are armed and ready, the samples are out. Dreamworks knows it, CRAY knows it the industry knows it, and I know, In The Know, knows it.

Everybody knows it.

SPARKS

There, JumpingJack knows it.

SPARKS

In fairness, AMD is starting to kick some ass in the IGP space too (though southbridges are a different story).

The problem with 4P is that while the margins are big, the volume isn't. If I recall correctly server is ~1/10 the volume of x86 and then consider that 1P and 2P is the dominant share of servers - you are left with some high margin 4P+ parts, but just not so many of them.

With more cores being packed into each die, I wonder if this will further eat into the 4P market. I have no clue, I'm just throwing it out there - anyone knowledgeable have any thoughts on this?

"In fairness, AMD is starting to kick some ass in the IGP space too (though southbridges are a different story). "

The ATI division of AMD has done a bang-up job here ... and probably offers the best overall, rounded out IGP chipset on the market.

SB does need some more work, but that is hardly noticable by the end user.

Unfortunately, I have a hard time seeing where this fits in with respect to intended application and marketing, except for a few niche' markets (HTPC for example).

- As good as it is relative to other IGP solutions, it still is not a choice means for gaming.

- As good as it is, for routine Vista Aero and general computing experience for typical users not gaming, one would see more benefit from a faster CPU than a better IGP.

- AMD's marketing such that it is, for an IGP, better at gaming (or play HD better) is ok for consumer/retail. But is completely irrelevant for the commercial space (where most of the mobile money/margins are). I mean... how many IT managers are going to worry if their employees can play Quake 4 at 'playable framerates of 25-30 FPS' or can watch a HD video on a 15" screen? Me thinks IT managers do not make thier purchasing decisions based on graphics performance :) ... an IT manager wants stability, low cost of ownership, security and managability -- Centrino (1 and 2) wins here hands down.

- How many gamers out there would settle for an IGP (even the 790G)? Again, as good as it is, it is not really reaching a 'high performance threshold', so on the DT it is kinda useless more or less. So the G35 can only do 8 FPS best case for Quake 4, the 790G may do 25 or 30 (average), but it will still jitter and the real experience just is not there.

All-in-all, it is a good product and will help them out in consumer/retail ... unfortunately, this is the lowest margin of all markets to be selling into.

http://www.overclockers.com/tips01364/

heh.

AMD #'s are in:

Excluding one time charges they missed earnings expectations -$0.60/share vs -0.52expected.

Revenue was flat (1.39Bil) to year ago period, and down 8% sequentially from last quarter. This does contains some one time stuff mixed up in there which inflates this # about 10%.

Margins were theoretically 52% (up from 41%), however if you take ot the nonsense of 200mm equipment sales it drops to 37% (down from last quarter's 41%, up from last Q2's 34%)

The operating loss was $143Mil, but again if you take out the shenanigans with 200mm equipment sales and factor our some restrutucting and other charges it was - $269Mil.

Editorial:

- Last quarters Q1 YoY comparisons were indeed misleading... this of course was due to the garbage with the Q4'06 stuffing of the channel (which lead to an artificially low Q1'07 and a good # to compare to).

- AMD did inflate the margins to get it over 50%, but even I, hardly a financial analysts found this impact out after looking at the report for all of about 2 minutes.

Though the balance sheet will show a nice 52% #. AMD will not probably take credit for it, but they won't go out of their way to explain it as artificial. When next quarter comes around and it drops (assuming they don't have another 200Mil of equipment to sell); they will surely explain the drop then to minimize it. Thus they kind of get credit for it now, but don't get nailed for it later.

- It'll be interesting to see if AMD can overcome the true 269Mil continued operation loss and get into the black in Q3 as promised.

- Gartner said PC demand growth has actually better than expected, Intel's #'s appear to reflect this, AMD's apparently does not. It's not clear if this means market share shift to Intel in Q2.

A few other key points:

1) AMD said both CPU units and ASP was down from Q1'08 and it was flat to last year's Q2'07 #'s

This is a bit odd as you would think ASP should be up a bit with K10's (especially compared to Q2'07 where there were no K10's).

2) GPU units were down from last quarter, but ASP was flat. Compared to last year, unit volumes are up but ASP was down. Quarterly revenue was down 5% from Q1 but up 18% from last Q2

I'm a bit surprised that ASP would be down YoY, but clearly AMD's graphics trend is better than the CPU trend. For them to gain 18% revenue while ASP's were down, means they must have really had some significant volume increases (or some 'creative' accounting). This does not bode well for Nvidia's quarter (in addition to the recent announcements)

Good info at:

http://biz.yahoo.com/bw/080717/20080717006045.html?.v=1

Ruiz is gone!

Post a Comment