"Real men have Fabs" - Jerry Saunders, former AMD CEO.

After all the dodging and lying about not having any plans going fabless, AMD finally admits that it is in fact going to sell its fabs. They intend to remain a minority share holder and team up with a company who haven’t got a single clue about semiconductors. But none of that matters because they have lots of money to spend. And in a time when the usual lenders are looking for a some kind of a bailout themselves, it’s either this arrangement or Chapter 11 for AMD.

"On Oct. 7, 2008, AMD and the Advanced Technology Investment Company announced the intention to create a new global enterprise, The Foundry Company, to address the growing global demand for independent, leading-edge semiconductor manufacturing. There is a strong shift to foundries occurring – particularly to foundries with the capacity to produce devices using leading-edge process technologies. With The Foundry Company, AMD will be able to unlock the value of its world-class manufacturing capability – by making it available to a growing community of fabless semiconductor companies. " - AMD's New Global Foundry page.

There's a lot already said about AMD's move. The best one that highlights the concerns more clearly is from Fabtech:

Another aspect that concerned me was the notion pumped out by AMD that demand for leading-edge foundry capacity was something that was in strong demand. Ask SMIC, Chartered or UMC how much of its capacity is allocated to 65nm-and-below production and you will find it is very small... Also, if demand for foundry capacity was that strong, then why are wafer ASPs in decline and the major foundries cutting CapEx each year?... Even worse is the fact that SMIC has struggled since birth to actually turn a profit, so why should we think that a new foundry start-up in Europe (and the U.S.) will fare any better?

The "growing trend" to go fabless is a decision forced upon companies due to the rising cost of running a Fab. This alarming trend have been identified by Intel in the late 90's. AMD knew this day was coming and set a goal of 30% market share just to avoid ending up where it is now. It's entertaining to see how AMD is making it all appear as if it was an advantageous choice.

How can it be advantageous when AMD will now have to ask another company to spend $Billions every time it wants new equipment for a new process technology. How can it not be disadvantageous when your main competitor do not have such bureaucratic problems. Short term, this move by AMD will buy them time for the next year or two. Long term, I can only see AMD becoming the next Transmeta. When The Foundry Company starts losing large sums of money they will become cost conscious and that's when problems begin. Against Intel's "tick-tock" execution, AMD will only struggle to keep up.

10.08.2008

AMD comes out the closet, says no longer a real man

by

Roborat, Ph.D

236

comments

![]()

8.07.2008

Strong Demand for Intel's Atom

Citigroup analyst Glen Yeung reiterates his Buy rating and $29 price target on Intel (INTC), citing channel checks that revealed strong demand for INTC's Atom processor:

"Field checks from Japan suggest Intel has ordered 20M Atom flip-chip packages for 3Q08 and 25M for 4Q08. This is orders of magnitude more than our modeled 2M and 2.5M units in that timeframe. These figures do sound aggressive to us (and some is likely inventory build) and so we believe a substantive haircut is appropriate. Nonetheless, even at half these levels, Atom is running well ahead of our expectations. We conclude that Intel's relatively aggressive 8.8% 3Q08 revenue growth guidance, while still prone to macro factors, looks more achievable in light of Atom strength".

I may have to give anecdotal evidence in support of Glen Yeung’s report. The lead time for ordering Atom processors from distributors have now gone up to 6 weeks! It's beginning to look like last year with Barcelona but only different. Atom demand has just gone through the roof as if every single technology firm has found some clever use for the low power microprocessor. Hopefully, Intel meets demand for the coming Christmas season. The concern about sales cannibalisation should be limited to computers below the performance range of Core 2 Duo, which as it stands today, equates to all of AMD’s SKUs.

by

Roborat, Ph.D

290

comments

![]()

7.17.2008

AMD Loses another $Billion in Q2'08 while Hector gets the boot

Bogged down by biased press and unfair benchmarks, AMD today reported second quarter 2008 revenue from continuing operations of $1.349 billion, a seven percent decrease (-7%)compared to the first quarter of 2008 and a three percent (3%) increase compared to the second quarter of 2007. As part of its previously communicated review of its non-core businesses, AMD decided to divest its Handheld and DTV product businesses, and therefore is classifying them as discontinued operations 1 for financial reporting.

In the second quarter of 2008, AMD reported a net loss of $1.189 billion, or $1.96 per share. For continuing operations, the second quarter loss was $269 million, or $0.44 per share, and the operating loss was $143 million. The results for continuing operations include a net favorable impact of $97 million, or $0.16 per share as described in the table below. Loss from discontinued operations was $920 million, or $1.52 a share, including asset impairment charges of $876 million, or $1.44 a share.

It may appear that AMD has mastered announcing earnings report in the midst of deflated expectations. Surprisingly, nobody seemed to care that AMD lost $270 million in the quarter and wrote off another Billion from its books. That's the AMD we're all familiar with, beating expectations the wrong way round.

But let's focus on the good news! No, Hector leaving can either be good new or bad news depending on which side of the fence you're sitting. His announcement in the midst of the report may have caught a lot of people by surprise, but like he said, it's been planned and talked about before. The real good news for AMD is that their new product line-up are gaining momentum. They never said which direction but still we're assuming it's getting design wins and a bunch of orders. AMD is also confirming together with Intel that the PC market is healthy. In fact it is so healthy that AMD just might lose a lot less in the 3rd quarter and probably break even in the 4th. AMD's promises might not worth much these days but this time the numbers do support it.

As for "SmartAss-et"(c), AMD didn't come out with any announcement but instead gave away a few more clues in the form of an easy riddle. They said, investment in the microprocessor business involves 3 things: process development, factories and chip design. And they said that, implementing smart-asset will take away two of those things. It doesn't take a genius to figure out that the two are investment in process development and factories. If AMD gets the deal then that would leave them to only focus on chip design . It does confirm that AMD is planning to go fabless. We've been discussing this several months ago while at the same time the blogger across the street thought that asset-smart was some kind of process improvement.

by

Roborat, Ph.D

204

comments

![]()

7.15.2008

No bankruptcy for Intel in Q2’08 - Shocker!

In fact they even went out and beat the general consensus by 3 cents. Demand for microprocessors have been very strong for the last 18 months that it's always a wonder why one company can take all the profit while the other member of the duopoly loses $Billions.

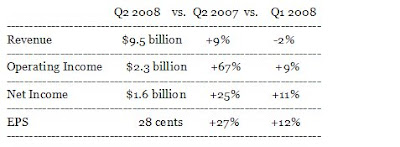

Intel Corporation today announced record second-quarter revenue of $9.5 billion, operating income of $2.3 billion, net income of $1.6 billion and earnings per share (EPS) of 28 cents. "Intel had another strong quarter with revenue at the high end of expectations and earnings up substantially year over year," said Paul Otellini, Intel president and CEO. "As we enter the second half, demand remains strong for our microprocessor and chipset products in all segments and all parts of the globe."  Results for the quarter included significantly lower NOR flash memory

Results for the quarter included significantly lower NOR flash memory

revenue along with restructuring and asset impairment charges of $96

million. Results for the first quarter of 2008 included the effects

of restructuring and asset impairment charges that lowered EPS by 4

cents. Results for last year's second quarter included tax items that

increased EPS by approximately 3 cents along with restructuring

charges of $82 million.

Guidance remains strong and unchanged from previous estimates for the remainder of the year.

-- Q3 Revenue: Between $10.0 billion and $10.6 billion.

-- Gross margin: 58 percent plus or minus a couple of points.

-- 2008 Gross margin: 57 percent plus or minus a couple of points, unchanged.

The desktop - laptop crossover for the consumer space happened in Q2 driving mobile ASPs down. Fortunately for Intel, they have another cross over happening in Q3 and that is the shift to 45nm. They expect unit cost to dramatically decline providing even more pricing advantage over AMD. The moment when Intel begins to recover investment spent on 45nm starts now until peak production volume. Only the company ahead on the process curve enjoys these returns. AMD on the other hand will spend billions on 45nm just so they can catch up. This is why Intel makes all the money.

Then again ,what we've seen since C2D was released is a general shift of financial analysts favouring Intel. These revenue, profit and margin benchmarks clearly favours Intel! All these making money thing doesn't represent real world.

by

Roborat, Ph.D

20

comments

![]()

6.03.2008

The Atomic Breakthrough

Doubts (including my own) about the viability of Intel’s Silverthorne program have been rife. The company’s exit from ARM based microprocessors shows that the business environment in the low-power embedded market is pretty hostile. When you have more than 10 different vendors, led by high-volume manufacturers the likes of Texas Instruments and Samsung, the margins can get very unattractive. Intel’s re-entry however, is a show of confidence and a belief in the ultra-mobile segment as a market with a huge potential for growth. Having learned their lesson, Intel is now differentiating themselves from ARM by sticking with the general purpose, off-the shelf and widely compatible, x86 Intel Architecture.

It’s a great idea until you realise that the Atom processor isn’t really up to par with ARM based processors when it comes to the flexibility of having the ideal performance at the right power draw. x86 is just too rigid in terms of performance, continues to be power hungry and remains too expensive to implement. The foundation of my scepticism on Intel’s Silverthorne strategy is solely based on the fact that the right market for it (high performance, low power, and high margins) truly does not exist. I was wrong.

There is a growing “and very mobile” market where an Atom based PC just happens to slot right in. It is a segment where high performance is required, power draw isn’t much of a factor and price isn’t the primary concern. I am referring to the In-car PC. Bill Gates once envisioned a PC in every home. Now Intel is betting on having a PC in every vehicle – that’s a potential market of ~72 million annually by 2010. I know we’ve heard so much about this in the past but this time around the automotive industry is ready. Expect high-end/super cars to have built-in PCs in 2010 just to establish the concept and expect wider deployment after 2012. This information comes from actual product roadmaps and not just my prediction.

The industry's move to PC’s to be the system that integrates the ever increasing functionality of the modern car is driven by cost. Believe it or not, an in-car PC will be the cheaper alternative real soon once the volume kicks in. A singular system that drives the audio & video, sat nav, phone system, internet, HVAC, telemetry, security and customised vehicle settings is fast becoming cheaper than having all the different parts bought, assembled and wired individually. Simplification goes a long way in high volume automotive manufacturing and the building blocks that can integrate the PC with the automotive networking standard (CAN/LIN) is very mature. The advent of the Atom removed the cost hurdles that existed for a complete integration.

At the moment the competition is between the incongruent ARM-based system and x86 (Intel and VIA's low power CPU's). Intel is currently leading the pack with their fully developed embedded solutions with major vehicle OEMs and system integrators as partners. Even Microsoft has stepped up in pushing the Windows Embedded platform. They are now competing head to head with Linux (automotive grade) which is quickly gaining support to become the automotive standard. Either way, developers are finding it easier to design human-machine interface applications using the widely adopted x86 instruction set. The Atom processor is beginning to shape like the breakthrough product Intel has been looking for.

by

Roborat, Ph.D

314

comments

![]()

5.06.2008

AMD's Asset-Lite could be something really awful

Anyone proficient with public relation strategies would be familiar with the concept of “controlled leaks” and “damage control. AMD’s filing of new charges against Intel and the rumour of an imminent restructuring announcement is just too much of a coincidence. Reading bits and pieces of the lawsuit reveals just how badly AMD’s business has become that anyone can only conclude that insolvency is inevitable. Conveniently, the asset-lite rumour started floating around giving just the needed amount of hope to anyone planning to continue to do business with AMD. The last thing AMD wishes is for its customers to think it is a risky option for future design platforms.

There are several ways of looking into the two AMD related events today. One that everyone should be familiar by now is the direct correlation between AMD’s cries of monopoly and its poor financial performance. Invariably, disastrous news from AMD always seem to follow everytime they talk about Intel's alleged illegal business practices. Anyone following AMD devotedly needs to hold on tight because this complaint is the biggest one yet. If AMD wasn't lying all along and indeed have an asset-lite strategy and were to announce it soon, based on the proximity with the new lawsuit, I can only conclude it’s going to be bad for AMD. Whatever the deal is, it must be something so awful that AMD needed to a file a lawsuit/excuse/scapegoat to justify their decision on asset-lite.

(thanks to enumae for the pdf link)

by

Roborat, Ph.D

227

comments

![]()

4.28.2008

Cray Dumps AMD

As promised from a previous blog entry , it was only a matter of time when Cray makes a deal with Intel and leave AMD out in the cold. Cray's 2007 earnings was drastically affected solely by AMD's product delays and poor performance: "... The decrease in product revenue (16%!!!) was principally due to delays in completing new products in time to recognize revenue in 2007 because of delays in product development and component availability" - Cray 2007 annual report.

WSJ : "Intel Corp. and supercomputer maker Cray Inc. announced an alliance that could add to pressures on Advanced Micro Devices Inc., and aid Cray's battles with much larger hardware vendors".

While the immediate implications are obvious, such as the decline in 4P market share for AMD and the associated drop in healthy margins, there are other far reaching but less obvious things to consider. For one, AMD's foothold on the server spare would completely evaporated once Nehalem ships with the likes of Cray on board. Design wins in HPC space are always critical due to the significantly longer product life cycle (sales and after-sales support). It is never easy to get back in this segment unless there are very compelling reasons to do so because price which seems to be AMD's only forte, plays a lesser role.

The news about the collaboration in R&D could only mean more bad news for AMD. Intel will be willing to pay for a significant portion (read: almost all) of the R&D as long as it involves their CPUs and a bit of pressure to forget about competing platforms. A clever and legal way of locking in your supplier for future products. Cray may be only one HPC vendor making such an announcement, but the shift between the big players have been going on for quite sometime now.

Expect Opteron based systems to disappear one by one from the supercomputer list in 2010.

by

Roborat, Ph.D

73

comments

![]()