After years of being mobile, I finally decided to get myself a cheap but capable desktop from a custom build site. The system is intended to become a home file server, video editing and casual gaming. The specs follows:

MOTHERBOARD: GigaByte GA-EP45T-DS3R Intel P45 Express CrossFireX Chipset LGA775 FSB1600 DDR3/1600 Mainboard w/GbLAN,USB2.0,IEEE1394a,&7.1Audio

CPU: Intel® Core™ 2 Quad Q8200 @ 2.33GHz 1333FSB 4MB L2 **Overclockable S&S*** Cache 64-bit (Read the reviews and I am already hating this CPU)

MEMORY: 4GB PC12800 DDR3/1600mhz Dual Channel Memory (G.SKILL NQ Series w/Heat Spreader ***Overclockable XXX***)

VIDEO: ATI Radeon HD 4870 PCI-E x16 1GB DDR5 Video Card

OPT DRIVE: SONY DUAL FORMAT 20X DVD±R/±RW + CD-R/RW DRIVE DUAL LAYER

HDD: 1TB SATA-II 3.0Gb/s 32M Cache 7200RPM Hard Drive (I know i should get 2 HDDs each for OS and Data)

Total < $1000

OS: Vista Ultimate (i get free SW from MS)

DISPLAY: Dell 22" 1900x1080p S2209W ($236 from Dell)

The Intel Core i7 platform at the moment is quite expensive and it was one of the main reason why I chose the lamest of all the 45nm Quad core. The CPU / Motherboard will be the next upgrade path I take in a couple of years and choosing one at the bottom of the table should hasten the transition. And since it is the video card that does most of the work these days I had to go with AMD's 4870 - best value for money if you ask me.

Feel free to criticize and show how one can do better without breaking the bank.

12.31.2008

New Desktop

by

Roborat, Ph.D

58

comments

![]()

12.30.2008

AMD Bankcrupt in 2009

Despite an improving economy, large-scale capital spending projects continue to be delayed in favor of maintenance spending. Technology shares continue to lag badly, and Advanced Micro Devices files bankruptcy. - Doug Kass, "20 Surprises for 2009".

"AMD ends 2008 (until we see fourth-quarter results) with $1.3 billion in cash, four times that amount in debt, and an operating loss of $1.9 billion over the last four quarters. Add to the mix an unprecedented slowdown in global economic demand and AMD's own tenuous market share in servers and PCs, and it becomes increasingly difficult to see the company's failure as an outlying event". - Michael Goodman, The Street.

2008 was supposed to be the year AMD's went bankrupt but was averted by a unique financial agreement with an entity that was enjoying record oil revenues. But the realities on the ground are changing and rapidly getting worse. While Intel continues to spend on 32nm, AMD on the other hand will look at someone else to make the several billion dollar gamble. The bet includes the following: a) that market demand is there to recover the investment, b) AMD will have viable products and c) AMD is still around (with an x86-license) to design chips. Terrible odds if you ask me.

by

Roborat, Ph.D

9

comments

![]()

11.12.2008

Bad For Intel, Catastrophic for AMD

Intel Corp. said late Wednesday that it expects financial results for its current, fourth fiscal quarter to be "below expectations," as the technology bellwether grapples with a flagging economy.

The chip maker said it now expects fourth-quarter revenue to be $9 billion, "plus or minus $300 million," which is lower than the company's previous expectation of between $10.1 billion and $10.9 billion.

Never mind Intel, at targeted gross margins of 55%, it will do just fine. The recuperating AMD will be the worst hit. Yet again, we can expect AMD to break it's promise of returning to profitability in the second half of 2008. We all saw what happened to AMD when Intel's gross margins drops close to 50% and needs to clear inventory. It's safe to assume things won't be different.

For now you can expect AMD to make noise and show its impoverished investors (AMD @ $2.57/share) that it is taking the necessary steps. It already announced laying off 500 employees. Soon they'll be talking about 32nm and reviving Bobcat. It's about being too little too late for AMD these days.

by

Roborat, Ph.D

195

comments

![]()

10.08.2008

AMD comes out the closet, says no longer a real man

"Real men have Fabs" - Jerry Saunders, former AMD CEO.

After all the dodging and lying about not having any plans going fabless, AMD finally admits that it is in fact going to sell its fabs. They intend to remain a minority share holder and team up with a company who haven’t got a single clue about semiconductors. But none of that matters because they have lots of money to spend. And in a time when the usual lenders are looking for a some kind of a bailout themselves, it’s either this arrangement or Chapter 11 for AMD.

"On Oct. 7, 2008, AMD and the Advanced Technology Investment Company announced the intention to create a new global enterprise, The Foundry Company, to address the growing global demand for independent, leading-edge semiconductor manufacturing. There is a strong shift to foundries occurring – particularly to foundries with the capacity to produce devices using leading-edge process technologies. With The Foundry Company, AMD will be able to unlock the value of its world-class manufacturing capability – by making it available to a growing community of fabless semiconductor companies. " - AMD's New Global Foundry page.

There's a lot already said about AMD's move. The best one that highlights the concerns more clearly is from Fabtech:

Another aspect that concerned me was the notion pumped out by AMD that demand for leading-edge foundry capacity was something that was in strong demand. Ask SMIC, Chartered or UMC how much of its capacity is allocated to 65nm-and-below production and you will find it is very small... Also, if demand for foundry capacity was that strong, then why are wafer ASPs in decline and the major foundries cutting CapEx each year?... Even worse is the fact that SMIC has struggled since birth to actually turn a profit, so why should we think that a new foundry start-up in Europe (and the U.S.) will fare any better?

The "growing trend" to go fabless is a decision forced upon companies due to the rising cost of running a Fab. This alarming trend have been identified by Intel in the late 90's. AMD knew this day was coming and set a goal of 30% market share just to avoid ending up where it is now. It's entertaining to see how AMD is making it all appear as if it was an advantageous choice.

How can it be advantageous when AMD will now have to ask another company to spend $Billions every time it wants new equipment for a new process technology. How can it not be disadvantageous when your main competitor do not have such bureaucratic problems. Short term, this move by AMD will buy them time for the next year or two. Long term, I can only see AMD becoming the next Transmeta. When The Foundry Company starts losing large sums of money they will become cost conscious and that's when problems begin. Against Intel's "tick-tock" execution, AMD will only struggle to keep up.

by

Roborat, Ph.D

236

comments

![]()

8.07.2008

Strong Demand for Intel's Atom

Citigroup analyst Glen Yeung reiterates his Buy rating and $29 price target on Intel (INTC), citing channel checks that revealed strong demand for INTC's Atom processor:

"Field checks from Japan suggest Intel has ordered 20M Atom flip-chip packages for 3Q08 and 25M for 4Q08. This is orders of magnitude more than our modeled 2M and 2.5M units in that timeframe. These figures do sound aggressive to us (and some is likely inventory build) and so we believe a substantive haircut is appropriate. Nonetheless, even at half these levels, Atom is running well ahead of our expectations. We conclude that Intel's relatively aggressive 8.8% 3Q08 revenue growth guidance, while still prone to macro factors, looks more achievable in light of Atom strength".

I may have to give anecdotal evidence in support of Glen Yeung’s report. The lead time for ordering Atom processors from distributors have now gone up to 6 weeks! It's beginning to look like last year with Barcelona but only different. Atom demand has just gone through the roof as if every single technology firm has found some clever use for the low power microprocessor. Hopefully, Intel meets demand for the coming Christmas season. The concern about sales cannibalisation should be limited to computers below the performance range of Core 2 Duo, which as it stands today, equates to all of AMD’s SKUs.

by

Roborat, Ph.D

290

comments

![]()

7.17.2008

AMD Loses another $Billion in Q2'08 while Hector gets the boot

Bogged down by biased press and unfair benchmarks, AMD today reported second quarter 2008 revenue from continuing operations of $1.349 billion, a seven percent decrease (-7%)compared to the first quarter of 2008 and a three percent (3%) increase compared to the second quarter of 2007. As part of its previously communicated review of its non-core businesses, AMD decided to divest its Handheld and DTV product businesses, and therefore is classifying them as discontinued operations 1 for financial reporting.

In the second quarter of 2008, AMD reported a net loss of $1.189 billion, or $1.96 per share. For continuing operations, the second quarter loss was $269 million, or $0.44 per share, and the operating loss was $143 million. The results for continuing operations include a net favorable impact of $97 million, or $0.16 per share as described in the table below. Loss from discontinued operations was $920 million, or $1.52 a share, including asset impairment charges of $876 million, or $1.44 a share.

It may appear that AMD has mastered announcing earnings report in the midst of deflated expectations. Surprisingly, nobody seemed to care that AMD lost $270 million in the quarter and wrote off another Billion from its books. That's the AMD we're all familiar with, beating expectations the wrong way round.

But let's focus on the good news! No, Hector leaving can either be good new or bad news depending on which side of the fence you're sitting. His announcement in the midst of the report may have caught a lot of people by surprise, but like he said, it's been planned and talked about before. The real good news for AMD is that their new product line-up are gaining momentum. They never said which direction but still we're assuming it's getting design wins and a bunch of orders. AMD is also confirming together with Intel that the PC market is healthy. In fact it is so healthy that AMD just might lose a lot less in the 3rd quarter and probably break even in the 4th. AMD's promises might not worth much these days but this time the numbers do support it.

As for "SmartAss-et"(c), AMD didn't come out with any announcement but instead gave away a few more clues in the form of an easy riddle. They said, investment in the microprocessor business involves 3 things: process development, factories and chip design. And they said that, implementing smart-asset will take away two of those things. It doesn't take a genius to figure out that the two are investment in process development and factories. If AMD gets the deal then that would leave them to only focus on chip design . It does confirm that AMD is planning to go fabless. We've been discussing this several months ago while at the same time the blogger across the street thought that asset-smart was some kind of process improvement.

by

Roborat, Ph.D

204

comments

![]()

7.15.2008

No bankruptcy for Intel in Q2’08 - Shocker!

In fact they even went out and beat the general consensus by 3 cents. Demand for microprocessors have been very strong for the last 18 months that it's always a wonder why one company can take all the profit while the other member of the duopoly loses $Billions.

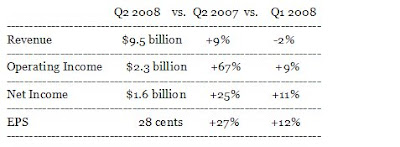

Intel Corporation today announced record second-quarter revenue of $9.5 billion, operating income of $2.3 billion, net income of $1.6 billion and earnings per share (EPS) of 28 cents. "Intel had another strong quarter with revenue at the high end of expectations and earnings up substantially year over year," said Paul Otellini, Intel president and CEO. "As we enter the second half, demand remains strong for our microprocessor and chipset products in all segments and all parts of the globe."  Results for the quarter included significantly lower NOR flash memory

Results for the quarter included significantly lower NOR flash memory

revenue along with restructuring and asset impairment charges of $96

million. Results for the first quarter of 2008 included the effects

of restructuring and asset impairment charges that lowered EPS by 4

cents. Results for last year's second quarter included tax items that

increased EPS by approximately 3 cents along with restructuring

charges of $82 million.

Guidance remains strong and unchanged from previous estimates for the remainder of the year.

-- Q3 Revenue: Between $10.0 billion and $10.6 billion.

-- Gross margin: 58 percent plus or minus a couple of points.

-- 2008 Gross margin: 57 percent plus or minus a couple of points, unchanged.

The desktop - laptop crossover for the consumer space happened in Q2 driving mobile ASPs down. Fortunately for Intel, they have another cross over happening in Q3 and that is the shift to 45nm. They expect unit cost to dramatically decline providing even more pricing advantage over AMD. The moment when Intel begins to recover investment spent on 45nm starts now until peak production volume. Only the company ahead on the process curve enjoys these returns. AMD on the other hand will spend billions on 45nm just so they can catch up. This is why Intel makes all the money.

Then again ,what we've seen since C2D was released is a general shift of financial analysts favouring Intel. These revenue, profit and margin benchmarks clearly favours Intel! All these making money thing doesn't represent real world.

by

Roborat, Ph.D

20

comments

![]()

6.03.2008

The Atomic Breakthrough

Doubts (including my own) about the viability of Intel’s Silverthorne program have been rife. The company’s exit from ARM based microprocessors shows that the business environment in the low-power embedded market is pretty hostile. When you have more than 10 different vendors, led by high-volume manufacturers the likes of Texas Instruments and Samsung, the margins can get very unattractive. Intel’s re-entry however, is a show of confidence and a belief in the ultra-mobile segment as a market with a huge potential for growth. Having learned their lesson, Intel is now differentiating themselves from ARM by sticking with the general purpose, off-the shelf and widely compatible, x86 Intel Architecture.

It’s a great idea until you realise that the Atom processor isn’t really up to par with ARM based processors when it comes to the flexibility of having the ideal performance at the right power draw. x86 is just too rigid in terms of performance, continues to be power hungry and remains too expensive to implement. The foundation of my scepticism on Intel’s Silverthorne strategy is solely based on the fact that the right market for it (high performance, low power, and high margins) truly does not exist. I was wrong.

There is a growing “and very mobile” market where an Atom based PC just happens to slot right in. It is a segment where high performance is required, power draw isn’t much of a factor and price isn’t the primary concern. I am referring to the In-car PC. Bill Gates once envisioned a PC in every home. Now Intel is betting on having a PC in every vehicle – that’s a potential market of ~72 million annually by 2010. I know we’ve heard so much about this in the past but this time around the automotive industry is ready. Expect high-end/super cars to have built-in PCs in 2010 just to establish the concept and expect wider deployment after 2012. This information comes from actual product roadmaps and not just my prediction.

The industry's move to PC’s to be the system that integrates the ever increasing functionality of the modern car is driven by cost. Believe it or not, an in-car PC will be the cheaper alternative real soon once the volume kicks in. A singular system that drives the audio & video, sat nav, phone system, internet, HVAC, telemetry, security and customised vehicle settings is fast becoming cheaper than having all the different parts bought, assembled and wired individually. Simplification goes a long way in high volume automotive manufacturing and the building blocks that can integrate the PC with the automotive networking standard (CAN/LIN) is very mature. The advent of the Atom removed the cost hurdles that existed for a complete integration.

At the moment the competition is between the incongruent ARM-based system and x86 (Intel and VIA's low power CPU's). Intel is currently leading the pack with their fully developed embedded solutions with major vehicle OEMs and system integrators as partners. Even Microsoft has stepped up in pushing the Windows Embedded platform. They are now competing head to head with Linux (automotive grade) which is quickly gaining support to become the automotive standard. Either way, developers are finding it easier to design human-machine interface applications using the widely adopted x86 instruction set. The Atom processor is beginning to shape like the breakthrough product Intel has been looking for.

by

Roborat, Ph.D

314

comments

![]()

5.06.2008

AMD's Asset-Lite could be something really awful

Anyone proficient with public relation strategies would be familiar with the concept of “controlled leaks” and “damage control. AMD’s filing of new charges against Intel and the rumour of an imminent restructuring announcement is just too much of a coincidence. Reading bits and pieces of the lawsuit reveals just how badly AMD’s business has become that anyone can only conclude that insolvency is inevitable. Conveniently, the asset-lite rumour started floating around giving just the needed amount of hope to anyone planning to continue to do business with AMD. The last thing AMD wishes is for its customers to think it is a risky option for future design platforms.

There are several ways of looking into the two AMD related events today. One that everyone should be familiar by now is the direct correlation between AMD’s cries of monopoly and its poor financial performance. Invariably, disastrous news from AMD always seem to follow everytime they talk about Intel's alleged illegal business practices. Anyone following AMD devotedly needs to hold on tight because this complaint is the biggest one yet. If AMD wasn't lying all along and indeed have an asset-lite strategy and were to announce it soon, based on the proximity with the new lawsuit, I can only conclude it’s going to be bad for AMD. Whatever the deal is, it must be something so awful that AMD needed to a file a lawsuit/excuse/scapegoat to justify their decision on asset-lite.

(thanks to enumae for the pdf link)

by

Roborat, Ph.D

227

comments

![]()

4.28.2008

Cray Dumps AMD

As promised from a previous blog entry , it was only a matter of time when Cray makes a deal with Intel and leave AMD out in the cold. Cray's 2007 earnings was drastically affected solely by AMD's product delays and poor performance: "... The decrease in product revenue (16%!!!) was principally due to delays in completing new products in time to recognize revenue in 2007 because of delays in product development and component availability" - Cray 2007 annual report.

WSJ : "Intel Corp. and supercomputer maker Cray Inc. announced an alliance that could add to pressures on Advanced Micro Devices Inc., and aid Cray's battles with much larger hardware vendors".

While the immediate implications are obvious, such as the decline in 4P market share for AMD and the associated drop in healthy margins, there are other far reaching but less obvious things to consider. For one, AMD's foothold on the server spare would completely evaporated once Nehalem ships with the likes of Cray on board. Design wins in HPC space are always critical due to the significantly longer product life cycle (sales and after-sales support). It is never easy to get back in this segment unless there are very compelling reasons to do so because price which seems to be AMD's only forte, plays a lesser role.

The news about the collaboration in R&D could only mean more bad news for AMD. Intel will be willing to pay for a significant portion (read: almost all) of the R&D as long as it involves their CPUs and a bit of pressure to forget about competing platforms. A clever and legal way of locking in your supplier for future products. Cray may be only one HPC vendor making such an announcement, but the shift between the big players have been going on for quite sometime now.

Expect Opteron based systems to disappear one by one from the supercomputer list in 2010.

by

Roborat, Ph.D

73

comments

![]()

4.17.2008

AMD's Q1 2008 Earnings (or lack of) Report

"AMD today reported first quarter 2008 revenue of $1.505 billion, a net loss of $358 million, or $0.59 per share, and an operating loss of $264 million. These results include an impact of $50 million, or $0.08 per share, from ATI acquisition-related charges. First quarter revenue decreased 15 percent compared to the fourth quarter of 2007 and increased 22 percent compared to the (abysmal) first quarter of 2007".

“A seasonally weak first quarter (natural trend therefore beyond AMD's control) was amplified by a challenging economic environment for consumers (people don't have money to buy PCs) and lower than expected (meaning awful) revenues of previous generation products (meaning obsolete), resulting in lower than expected revenues in all business segments. However, we are encouraged (interesting choice of words, why not speak in volumes like "overwhelmed") by the market acceptance of our Quad-Core AMD Opteron™ server processors as well as our new chipset and graphics offerings,” said Robert J. Rivet, AMD’s Chief Financial officer. “We remain committed to achieve operating profitability in the second half of the year, driven by our portfolio of new products and platforms (which NEW product?) and aggressive restructuring programs (meaning layoffs).

It appears as if AMD is back to square one. Not surprisingly, a product line-up of buggy, handicapped and obsolete products guarantees nothing else but massive losses. AMD may pretend all they want that they're giving what the customers want, the latest financial statement says otherwise. It is shocking that they can claim to be having a difficult market environment when their direct competition is thriving. I would like to think that they're lying and know what the hell is going because it sounds as if they're not living in reality.

What is surprising is that AMD admitted to the server share loses and the massive decline in overall unit shipment. Other alarming trends in their numbers include margins going south from 44% last quarter to 42% in Q1'08. While revenue declined $265M compared to last quarter together with unit sales, MG&A increased by $20M! The graphics division which was supposed to have a strong product lineup (at least relative to Computing) also made a loss.

To fix all their problems Hector once again pulled out the old (one year old to be exact) black rocket called "asset-smart". While I could have sworn hearing laughter through the muted telephones, at least one analyst was too pissed to mention that he's getting tired of waiting for the "wait-and-see-if-we-make-it-to-break-even-asset-smart" strategy. Of course, like always Hector said he will make an announcement "soon". With the way AMD puts emphasis on asset-smart whenever they're in trouble and less when they're doing better, it is beginning to look like asset-smart really is filing chapter 11. People who think Hector isn't smart don't know what they're talking about.

by

Roborat, Ph.D

126

comments

![]()

4.15.2008

INTEL's Q1 2008 Earning's Report

- Record Server Microprocessor Revenue

- Revenue up 9 Percent Year-over-Year

- Gross Margin up 4 Points Year-over-Year

- Operating Income up 23 Percent Year-over-Year

- Net Income $1.4 Billion; EPS 25 Cents

SANTA CLARA, Calif., April 15, 2008 - Intel Corporation today announced record first-quarter revenue of $9.7 billion, operating income of $2.1 billion, net income of $1.4 billion and earnings per share (EPS) of 25 cents.

"Our first quarter results demonstrate a strengthening core business and a solid global market environment," said Paul Otellini, Intel president and CEO. "We saw healthy demand for our leading-edge processors and chipsets across all segments. Looking forward, we remain optimistic about our growth opportunities as we continue to reap the benefits of our 45nm technology leadership."

It appears like business as usual for Intel despite the macro-economic turmoil affecting the financial industry. Strong server sales dominate the earning's call with frequent mention of grabbing market share from AMD (estimate ~$100M lost to Intel). AMD's situation is so awful that one analyst asks if Intel takes into consideration their competitor's "too dire" situation and how any of their actions could adversely affect the competition. However which way you read into that statement, it is like saying, "are you making sure you're not hurting AMD too much to kill it and just apply enough pressure to keep it half-dead on life support?"

Outlook for the second quarter and the rest of the year remains strong with plenty of optimism for Atom and a brief mention that Nehalem is on track. Business as usual for Intel with a strong product line-up means a lot of red ink on Thursday as AMD reports.

by

Roborat, Ph.D

12

comments

![]()

4.08.2008

AMD's Annual Layoff Exercise

"Advanced Micro Devices, reporting a slump in sales, said Monday it will cut 1,680 employees, or about 10 percent of its worldwide workforce, between now and September. An AMD spokesman said the move was part of a cost-cutting plan to help return the company to profitability. He said the company doesn't know how many will be affected at its two Silicon Valley campuses. AMD said that the revenue drop was caused by lower than expected sales across all business segments, which it attributed to an anticipated seasonal decline". -siliconvalley.com

Expect every horrible announcement to be beautifully written and without fail stated in a positive manner. It is amusing that AMD calls a sudden announcement of workforce reduction as a cost-cutting "plan". Intel announced a 10% workforce reduction over the course of several quarters to save $2B annually. Now that is what you call a plan.

It's not surprising that AMD's sales are off by around $100M. AMD's customers are left to choose between an aging Athlon or a Phenom that does not have guaranteed delivery dates. Large OEM planners are having problems booking production plans for Phenom based systems - or so I heard. To most companies with tiny margins, on-time delivery is key:

Citigroup wrote about the issues with Dell this morning, saying: "Our analysis suggests that a source of AMD's shortfall is Dell's decision to reduce their AMD exposure. Consistent with speculation throughout the quarter, AMD's shortcomings in two flagship products (Barcelona and Phenom) was the likely sore spot for Dell. - cnbc

by

Roborat, Ph.D

58

comments

![]()

3.08.2008

The Task Manager Déjà vu

AMD launched a new batch of promises at CeBIT in Hannover. 45nm Deneb was demonstrated running Task Manager. The last time AMD used tskmgr.exe to demonstrate working silicon things didn't quite turn out according to plan. AMD promised to ship 45nm products by the second half of 2008. Nobody seems to disagree that this meant the fourth quarter of 2008. If AMD keeps its promise then that puts them a year behind Intel, which is again a major miscalculation from the blogger next door. Never mind the fact that Intel built up inventory in Q3'07, none of that is as important as the embarrassment for those who thought AMD is closing the gap. As usual, AMD is doing the job of correcting its own disillusioned fan base.

Not to make AMD followers a bit more nervous but this is the first time AMD will be alone implementing a microprocessor architecture on a new process. At the moment all that IBM is offering on 45nm are small ASIC designs on SOI and low power RF CMOS. Not quite a show of confidence on the new process. Clearly there is a sense that AMD is being forced to move on to the unrefined 45nm process. Maybe because it needs to show it is catching up or maybe they’re in a hurry to move away from their disastrous (and also hurried) 65nm process. Either one is valid enough. Meanwhile, the less pressured IBM waits for its alternative metal gate solution before implementing on their Power architecture. IBM has a crucial reason for waiting, and I’ll leave it for the boards to discuss.

But when it comes to announcements you have to give to AMD for cleverly stirring things up a little. It’s hard to get excited about 45nm promises when the competition is shipping them in volumes since last year, but they managed to pull it off. Throwing in technical jargons and masking process weaknesses into an advantage seemed to have worked for the scrappy little company. They got the press to notice so that’s job done for the over worked AMD PR machine. They just need to work more on coordinating their statements:

AMD spokesperson 1: “A common misconception is that being first to a new process technology generation is the fundamental determinant of performance and energy efficiency leadership. AMD has proven this to be false."

AMD spokesperson 2: “AMD's 45nm process generation is engineered to enable greater performance -per-watt capabilities in AMD processors and platforms”.

by

Roborat, Ph.D

202

comments

![]()

2.28.2008

If you can't beat them, join them

I am currently in the middle of a big project and temporarily finding it a quite a challenge to maintain the same level of updates as you may have seen in the past. AMD's lack of response together with the apologetic tone from its followers doesn't make it easy either.

To improve the discussion and level of activity I would like to open up the blog to co-authors. I encourage everyone to nominate who they think should be hitting the front page instead of the comments page. Sort of "voluntelling" them to become authors. Anyone courageous enough can also come forward and anyone wishing to remain anonymous can e-mail me at roborat2000@yahoo.com.

I ask only that we maintain our dedication to "truthiness".

by

Roborat, Ph.D

52

comments

![]()

2.12.2008

Intel and the European DisUnion

I assume everyone is aware that Intel's Munich office along with major computer retailers have been raided.

EU regulators raid Intel offices

BRUSSELS (AFP) — EU antitrust regulators stepped up a probe into microchip giant Intel on Monday by raiding the US company's German offices and computer retailers on suspicions they might have stifled competition.

The European Commission "has reason to believe that the companies concerned may have violated (EU) rules on restrictive business practices and/or abuse of a dominant market position," a statement said. It did not disclose the number or names of companies raided, or divulge where they took place, saying only that "commission officials were accompanied by their counterparts from the relevant national competition authorities."

On the surface there seems to be nothing new here as the EU's obvious distaste for dominant American companies is pretty much well established. It is the behind the scene involvement of the German government that raises a few eyebrows. There is an obvious element of politics involved here and AMD seems to know where and when to pull the strings. One thing anyone needs to know about the European Union is the dis-unity. Behind the curtain, everyone is either fighting for it's own interest, or politicians trying to seek re-election.

Maybe Intel is indeed guilty of violating the EU's competition law and deserve what they got. But then again maybe someone is just trying to save face. Some politician isn't looking good at the moment after granting €262M last year to AMD after promising to run 2 Fabs. Seeing that the AMD bet is a mistake it isn't too hard to imagine why anyone want somebody to blame. In fact it happens more frequently than you think. You have another New York politician who has wasted millions in setting up the infrastructure for an AMD fab that isn't going to happen. Guess what happens next? (Intel gets a subphoena).

by

Roborat, Ph.D

100

comments

![]()

1.25.2008

The importance of the performance crown

Mercury Research published their numbers showing some very interesting facts. Anyone with doubts about the importance of keeping the performance crown needs to look at this graph.

Breaking it down further by market segment it becomes apparent what Intel meant by ‘walking away’ from some of the businesses. AMD’s mobile ASP is even lower than Intel’s desktop prices. Another thing to note is the continuous price erosion on Intel’s mobile segment. The gap between mobile and desktop is diminishing due to the tremendous demand for lower priced laptops towards the end of 2007. One can get a sense of how AMD is well entrenched in this space forcing Intel to lower prices if it wants to get back market share. The surge in Q207 server ASP for AMD comes from the Iranian supercomputer purchase which is rumoured to be paid in oil.

Breaking it down further by market segment it becomes apparent what Intel meant by ‘walking away’ from some of the businesses. AMD’s mobile ASP is even lower than Intel’s desktop prices. Another thing to note is the continuous price erosion on Intel’s mobile segment. The gap between mobile and desktop is diminishing due to the tremendous demand for lower priced laptops towards the end of 2007. One can get a sense of how AMD is well entrenched in this space forcing Intel to lower prices if it wants to get back market share. The surge in Q207 server ASP for AMD comes from the Iranian supercomputer purchase which is rumoured to be paid in oil. One thing that needs to be taken into context when looking at these figures is the fact that AMD lost a lot of money in 2007 while Intel took in healthy profits. Mentioned in an earlier blog, both companies have adjusted their business model to try and meet historic margin levels. And to some degree we have seen results. But as Intel and AMD continue to battle it out, the one without the superior product has no option but to compete on price. The problem is there isn’t a lot of wiggle room starting from $60 per CPU.

One thing that needs to be taken into context when looking at these figures is the fact that AMD lost a lot of money in 2007 while Intel took in healthy profits. Mentioned in an earlier blog, both companies have adjusted their business model to try and meet historic margin levels. And to some degree we have seen results. But as Intel and AMD continue to battle it out, the one without the superior product has no option but to compete on price. The problem is there isn’t a lot of wiggle room starting from $60 per CPU.

by

Roborat, Ph.D

179

comments

![]()

1.23.2008

A Review of the IDC numbers

I can see that someone has done a ‘Sharikou’ on Intel’s recent financial performance. A ‘Sharikou’ is an analysis method popularised by a similarly named blogger, where a desired result is only realised by varying the point of reference. Ignoring the usual method of 'like-for-like' or sequential comparisons, the blogger instructs his readers to compare Intel’s 2007 numbers with 2005 to get a “better understanding”. He doesn’t justify why his method gives a better understanding, but at least you can see that Intel’s revenue and margins are trending down – ‘Sharikou’ method successfully utilised.

IDC numbers (using only conventional methods of comparison) were released showing interesting trends. The total 2007 processor volume went up 12.5% while revenue only improved by 1.7%. IDC says that there was a degree of price erosion that occurred earlier in the year. True enough, but when someone suggests that Intel isn’t lean because it can’t reproduce the same margins as two years ago, I feel sorry for the poor analysis, and quite frankly, it isn’t surprising whenever the “Sharikou” is applied. In a duopoly where the market or revenue share is a zero sum equation (almost), comparing how much AMD and Intel performed using the same frame of reference, makes the most sense.

Intel and AMD did see an overall decrease in ASP mainly because of the larger presence of AMD in the notebook and server space (margins naturally decline as market share in a doupoly approaches 50%%). But it is interesting to see who was hit the hardest:

Global 2007

Volume increase: 12.5%

Revenue: $30.55B

Revenue increase: 1.7%

Intel 2007

Revenue (Digital Enterprise / Mobility CPUs): $25.89B

Revenue increase: 8.7%

AMD 2007

Revenue (Computing): $4.70B

Revenue increase: -12.4% (down from $5.64B)

It is quite evident that AMD has taken the brunt of the ASP erosion considering that market share only shifted by a couple of percentage points while both companies reported record volume shipped. In terms of laptop and server prices it is clear that the business environment has changed and the good news is both companies are taking steps to adapt. AMD has delayed Fab38 and for obvious reasons. At the moment they have the capacity to supply 80 million CPUs for the 70–75 million demand (2008) for AMD based systems. They now seemed to be content to play in the box they were forced to be in. Intel on the other hand plans to improve by divesting non-performing businesses, creating new high margin products and the usual, by outpacing the competition with better products using a better process.

It is premature and erroneous to dismiss the benefits of Intel’s 45m before the ramp is complete. Intel's guidance of flat margins throughout 2008 is likely due to their tendency to be on the cautious side and isn't sufficient to make quick assumptions on the company's cost structure or pricing strategy. Meanwhile AMD can only expect more difficulty as K8 gets even more outdated and K10 is ramped with very poor yields. In 2007 AMD managed to ship 400K QC units. It isn’t such a big number considering this is just 0.6% of their total volume. Barcelona or K10 is considered by many as a disaster in terms of performance. Financially, we have yet to witness how much damage it can do to AMD… assuming of course AMD ramps K10 on 65nm.

by

Roborat, Ph.D

29

comments

![]()

1.18.2008

The comeback kid? AMD's Q4/2007

SUNNYVALE, Calif. — Jan. 17, 2008 — AMD (NYSE: AMD) today reported fourth quarter 2007 revenue of $1.770 billion, an 8 percent increase compared to the third quarter of 2007 and flat compared to the fourth quarter of 2006 2 . In the fourth quarter of 2007, AMD reported a net loss of $1.772 billion, or $3.06 per share, and an operating loss of $1.678 billion. Fourth quarter net loss included charges of $1.675 billion, or $2.89 per share, of which $1.669 billion were operating charges. The non-cash portion of the fourth quarter charges was $1.606 billion.

This is quite a comeback considering so much negative news surrounding the company. The substantial increase in revenue while keeping OpEx flat helped drive the company to almost break even. In fact the computing group reported an operating profit of $21M. Overall AMD beats the overly negative market consensus of $-0.36 per share reporting in a loss of only $0.17 per share. Margins were up 3% to 44% which would lead anyone to wonder what could have happened if Barcelona was executed as planned. While the $1.606B goodwill charge significantly affects the valuation of the company, one can argue that the stock seem to have already taken this into account.

From the company’s business standpoint it appears that AMD is doing all the right things. Key to the improvement is the change in priority. Like Hector said, their number one goal is profitability while the second is serving the customers. Essentially that means AMD is optimising product mix to generate the most revenue as opposed to running both their Fabs at peak volume just to grab market share. It seems like Hector has indeed humbly learned his lesson and breaking the monopoly is off the agenda.

From a product execution standpoint AMD says that B3 is ready. The conference call painted a better picture of how the Barcelona fix is progressing. Engineering samples will be out in a couple of weeks while production samples will be shipped later in Q2. This sounds like Barcelona will only reach the general market right around end of Q2, probably Q3. AMD shipped close to 400,000 quad cores with the ratio of 2:1 (desktop to servers) in Q4. It is difficult to gauge the significance of that quantity in terms of margins but clearly it is just a large number thrown out there to impress people. It appears like it worked.

While it is evident that AMD is trending in the right direction, their strategy remains untested. Revenue may be trending upwards but so was demand in the 2nd half of 2007. The company grew revenue using existing products but their viability is relative to the competition who seems to be executing at a faster pace. AMD’s plan to return to profitability relies heavily on new products which appears to be limited to the mid to low-end segment (tri-core, 65W products). While this was proven to be marginally profitable in a healthy market, AMD needs to prove they can do the same feat in the midst of a price war. One can’t help but wonder if the actions of another entity plays a bigger influence on AMD’s profitability.

by

Roborat, Ph.D

48

comments

![]()

1.15.2008

Intel's Q4/2007 Report

Intel's Q4/2007 numbers:

• 2007 Operating Income $8.2 Billion, up 45 Percent

• Fourth-Quarter Revenue $10.7 Billion, up 10.5 Percent Year-over-Year

• Gross Margin 58 Percent, up 8.5 Points Year-over-Year

• Operating Income $3 Billion, up 105 Percent Year-over-Year

• Record Microprocessor and Chipset Units and Revenue

• Net Income $2.3 Billion; EPS 38 Cents

Q1 2008 Outlook

• Revenue: Between $9.4 billion and $10 billion.

• Gross margin: 56 percent plus or minus a couple of points.

2008 Outlook

• Gross margin: 57 percent plus or minus a few points.

• R&D: Approximately $5.9 billion.

• MG&A: Approximately $5.5 billion.

• Capital spending: $5.2 billion plus or minus $200 million.

Impressive figures, but unfortunately when a bear market looks for tell-tale signs of an impending recession they always find something negative to focus on. Take for instance Intel missing consensus by around $100M. "Aha!" said the market. "There's your global recession right there!".

Assuredly, the conference call was peppered with leading questions. In order to justify their recent industry downgrade, analysts tried their best to make Paul and Stacey say what they wanted to hear. Several questions focused on the inventory situation, looking for any cancelled orders and then drilled on the relatively flat gross margin prediction for 2008. But the analysts never got what they wanted. Instead, what they heard was exactly the opposite. Inventories are lower than expected; demand, especially in server and mobile, is solid while the market is expected to grow double-digits in 2008. Intel's slightly lower revenue was in fact primarily due to significantly lower memory pricing (a result of a global over capacity), and the charge for the NAND spin-off. While none of the shortfall was attributed to Intel’s computing group, nonetheless, Intel admits it is prudent to be cautious.

As for AMD, the general outlook Intel provided can be taken as positive news. A healthy market relieves pressure on margins going forward allowing AMD time to put things in order. The only problem for the scrappy little company is trying to catch up to a more focused and much leaner competitor. As Intel delivers on Silverthorne, 65nm chipsets, WiMax and Nehalem, 2008 is set to be AMD’s toughest year yet.

by

Roborat, Ph.D

30

comments

![]()

1.11.2008

AMD delays Phenom because of pesky bugs customers

AMD admits to recent rumours that higher speed Phenoms (9900 and 9600) will be delayed until the second quarter. Luckily for AMD, nobody waits for mid-to-low-end CPUs. So except for a few people at AMDZONE, nobody is really disappointed by this news. AMD vehemently denies that the delay is due to the TLB bug found back in November. “The B3 stepping is not bugged”, according to INQ reporter Charlie Demerjian after speaking to AMD’s Pat Moorehead. Pat Moorehead is the Executive VP of Marketing at AMD who is coincidentally also running the Barcelona Debugging Task Force. If we can take the word of an AMD executive then the company should now be focusing on understanding why their process is producing energy efficient chips instead of 9900 Phenoms.

Energy efficient chips are what our customers want, declares AMD, which is very fortunate because this is all they have anyway. Either this is a profound coincidence or AMD is confusing desktop with OLPC demand. Phenom 9900 and 9600 will be pushed out until next quarter because AMD is now trying to meet the ‘unusual’ demand in this low margin segment using nothing but very expensive parts. While some analyst believe that such a move is void of any logic, some would argue that at least AMD isn’t throwing the CPUs away like McDonald’s with their silly 15-minute rule on burgers. (But if McDonald’s goes into financial trouble and tried to sell cold and stale burgers because they insist it is what the customers what, it would just be pathetic).

Similar to how the tri-core Phenom is targeted at the tiny tetraphobic market in China, AMD believes that there is a healthy market out there for expensive energy efficient processors. Well at least until they figure out a way to fix Phenom.

by

Roborat, Ph.D

44

comments

![]()

1.09.2008

~$1.5B Anyone?

With the current price AMD’s stock is trading today, all you need is roughly $1.5B to take a majority stake in the company. Of course this is theoretical as such move requires approval from regulators, AMD’s board of directors and a lengthy cross-license negotiation with Intel. Trading at a 52-week low of $5.53, more investors abandon AMD's stock amid fears that a U.S. recession could be the final straw that would bring the company into insolvency.

After several days of trending synchronously with AMD due to a series of sector downgrades, Intel traded up today on a repot from Gold Sachs:

"Intel is very well positioned to continue to gain (market) share, particularly in servers, given AMD's disappointing execution," Goldman analyst James Covello wrote in a report (probably after readings some fierce comments from Sparks).

Meanwhile investors continue to dump AMD probably just for the sake of pissing Hector Ruiz even further. An open letter from Mr Douglas McIntyre (24/7wallst) calls on AMD’s board to dump Mr Ruiz who seems to be the only person in the world who doesn’t understand why the stock continues to slide.

An Open Letter To Frank Clegg, AMD (AMD) Board Member: “As a member of the AMD (AMD) board, you know how deeply disappointed the market is with the performance of the company's CEO Hector Ruiz. AMD shares hit another 52-week low today at $5.77. Wall St. has lost faith in the company's ability to release products on time and improve gross margins.”

When a company loses around $2B in a good year, one of the best the industry has seen in quite a while, just imagine how things could turn out if the economy enters a recession... And just when you thought things couldn’t possibly get worse.

by

Roborat, Ph.D

32

comments

![]()

1.02.2008

AMD’s Law: “Just when you thought it couldn’t possibly get worse…”

For AMD, 2007 was the year where everything turned south. Just when you thought it can’t possible get any worse, AMD’s management comes out with more bad news. In fact, it’s gone so horrible wrong that I am starting to feel a sense of weariness from too much AMD bashing. To be honest, it was most exciting when AMD’s decline was debatable. Then it was instantaneously gratifying when our analysis turned out to be correct. But today when we finally see closet fanboys re-write our opinions while gobbling up large quantities of crow, you begin to gather a sense of indifference. Have we heard so much bad news about AMD that we’re beginning to feel numb?

Case in point: today Banc of America downgraded AMD’s stocks from “neutral” to “sell”. Frankly, telling someone to sell when they have lost more than half of its value is quite useless especially when the reasons stated aren’t new and profound:

“Irrespective of whether AMD will be able to deliver on its promise to ramp the much-delayed Barcelona platform in volumes by the first or second quarters of 2008, we believe Barcelona will do very little to stem the share losses AMD will likely witness in servers and desktops vs. Intel's more competitive line-up. Furthermore, we believe that AMD's cost structure will be further pressured by higher depreciation and higher material costs associated with the ramp of quad core parts in 2008,"

I’m sure there’s a lot of AMD shareholders who would appreciate such advice right about a year ago! Nonetheless, finding this news completely uninteresting proves my point. On the other hand, an excess of gloom and doom of AMD can only be good for the company. Expect AMD’s stock to tick higher on any news that’s less than disastrous (i.e., see Q3’07 report). Clever management strategy, I say.

by

Roborat, Ph.D

95

comments

![]()