Bogged down by biased press and unfair benchmarks, AMD today reported second quarter 2008 revenue from continuing operations of $1.349 billion, a seven percent decrease (-7%)compared to the first quarter of 2008 and a three percent (3%) increase compared to the second quarter of 2007. As part of its previously communicated review of its non-core businesses, AMD decided to divest its Handheld and DTV product businesses, and therefore is classifying them as discontinued operations 1 for financial reporting.

In the second quarter of 2008, AMD reported a net loss of $1.189 billion, or $1.96 per share. For continuing operations, the second quarter loss was $269 million, or $0.44 per share, and the operating loss was $143 million. The results for continuing operations include a net favorable impact of $97 million, or $0.16 per share as described in the table below. Loss from discontinued operations was $920 million, or $1.52 a share, including asset impairment charges of $876 million, or $1.44 a share.

It may appear that AMD has mastered announcing earnings report in the midst of deflated expectations. Surprisingly, nobody seemed to care that AMD lost $270 million in the quarter and wrote off another Billion from its books. That's the AMD we're all familiar with, beating expectations the wrong way round.

But let's focus on the good news! No, Hector leaving can either be good new or bad news depending on which side of the fence you're sitting. His announcement in the midst of the report may have caught a lot of people by surprise, but like he said, it's been planned and talked about before. The real good news for AMD is that their new product line-up are gaining momentum. They never said which direction but still we're assuming it's getting design wins and a bunch of orders. AMD is also confirming together with Intel that the PC market is healthy. In fact it is so healthy that AMD just might lose a lot less in the 3rd quarter and probably break even in the 4th. AMD's promises might not worth much these days but this time the numbers do support it.

As for "SmartAss-et"(c), AMD didn't come out with any announcement but instead gave away a few more clues in the form of an easy riddle. They said, investment in the microprocessor business involves 3 things: process development, factories and chip design. And they said that, implementing smart-asset will take away two of those things. It doesn't take a genius to figure out that the two are investment in process development and factories. If AMD gets the deal then that would leave them to only focus on chip design . It does confirm that AMD is planning to go fabless. We've been discussing this several months ago while at the same time the blogger across the street thought that asset-smart was some kind of process improvement.

7.17.2008

AMD Loses another $Billion in Q2'08 while Hector gets the boot

by

Roborat, Ph.D

204

comments

![]()

7.15.2008

No bankruptcy for Intel in Q2’08 - Shocker!

In fact they even went out and beat the general consensus by 3 cents. Demand for microprocessors have been very strong for the last 18 months that it's always a wonder why one company can take all the profit while the other member of the duopoly loses $Billions.

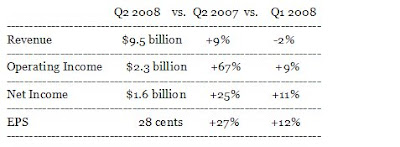

Intel Corporation today announced record second-quarter revenue of $9.5 billion, operating income of $2.3 billion, net income of $1.6 billion and earnings per share (EPS) of 28 cents. "Intel had another strong quarter with revenue at the high end of expectations and earnings up substantially year over year," said Paul Otellini, Intel president and CEO. "As we enter the second half, demand remains strong for our microprocessor and chipset products in all segments and all parts of the globe."  Results for the quarter included significantly lower NOR flash memory

Results for the quarter included significantly lower NOR flash memory

revenue along with restructuring and asset impairment charges of $96

million. Results for the first quarter of 2008 included the effects

of restructuring and asset impairment charges that lowered EPS by 4

cents. Results for last year's second quarter included tax items that

increased EPS by approximately 3 cents along with restructuring

charges of $82 million.

Guidance remains strong and unchanged from previous estimates for the remainder of the year.

-- Q3 Revenue: Between $10.0 billion and $10.6 billion.

-- Gross margin: 58 percent plus or minus a couple of points.

-- 2008 Gross margin: 57 percent plus or minus a couple of points, unchanged.

The desktop - laptop crossover for the consumer space happened in Q2 driving mobile ASPs down. Fortunately for Intel, they have another cross over happening in Q3 and that is the shift to 45nm. They expect unit cost to dramatically decline providing even more pricing advantage over AMD. The moment when Intel begins to recover investment spent on 45nm starts now until peak production volume. Only the company ahead on the process curve enjoys these returns. AMD on the other hand will spend billions on 45nm just so they can catch up. This is why Intel makes all the money.

Then again ,what we've seen since C2D was released is a general shift of financial analysts favouring Intel. These revenue, profit and margin benchmarks clearly favours Intel! All these making money thing doesn't represent real world.

by

Roborat, Ph.D

20

comments

![]()